3 Tips for Thriving in a Soft Reinsurance Market

A lack of major catastrophes in recent years (aside from this year), increased competition brought on by the inflow of alternative capital from investors, and the need to spend more time and resources processing increasing volumes of data are several of the key forces that have created today’s soft reinsurance market conditions. With combined ratios increasing and global property reinsurance rates online (ROLs) having declined for 11 straight years, describing the underwriting environment as “challenging” would be an understatement. Read More

Today’s Soft Reinsurance Market: Why Are Combined Ratios Continuing to Rise?

Today's soft reinsurance market has put increasing amounts of pressure on traditional reinsurers to develop new strategies and tactics to survive. Combined ratios are increasing, and it's a sink or swim environment that can feel like a futile race to 100%. In this post we'll take a look at some of the forces that have created today's soft market conditions and connect them back to their effect on combined ratios. Read More

4 Things You Should Know About Reinsurance Sidecars

In the wake of the 2005 Atlantic hurricane season’s record-setting catastrophic loss year and in response to the increased demand of capital adequacy and requirements, sidecars gained popularity in the (re)insurance market as an important strategic tool. They have since transitioned from an instrument created to cope with the impact of large-scale catastrophic losses, to an efficient quota-share capacity instrument used by (re)insurers to leverage their relationships with capital markets.

Insurance Fundamentals: How to Interpret Combined Ratios and Related Metrics

One of the most commonly cited metrics of a (re)insurance company’s success—and perhaps a term those new to the industry are unfamiliar with—is the combined ratio. Read More

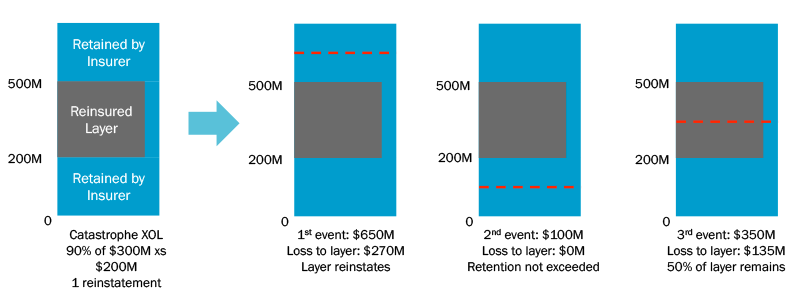

What to Watch For in Analyzing Reinsurance Contracts

With the current state of the reinsurance market—dropping prices, increasing M&A activity, influx of other capital sources, a lack of major CAT events—it’s more important than ever to make optimal decisions when it comes to managing your portfolio. Part of that equation, especially as structures get more creative and complex, is to have a solid understanding of the contracts you are modeling and ensure that they are being analyzed correctly. Read More

4 Real-Time (Re)Insurance Portfolio Metrics Demystified

As (re)insurance companies accumulate more and more risks, the data contained in these portfolios continues to grow. Understanding how to make sense of it all is critical, and there is no shortage of metrics one can employ. Sure, there are the basic CAT model output metrics such as Average Annual Loss, Exceedance Probability (EP), and Return Periods discussed in our recent blog post—but what other portfolio metrics can provide additional insights? Read More